How the Sports Industry Will Change in 2026? A Deeper Look

“Football can change pretty quickly,” said Swansea City’s head coach, Vitor Matos, reflecting the unpredictable nature of sports results. However, this sentiment also perfectly describes the current state of the global sports business and technology landscape in 2026.

What used to shift over decades is now flipping in months. Media deals are rewriting the rulebook. Tech is no longer optional. Fans are behaving differently, and leagues are scrambling to keep up.

Watching sports used to be simple. You turned on the TV and found the game. In 2026, it feels more like a scavenger hunt. Major leagues are slicing up their media rights and selling them to the highest bidder. The NFL is leaning toward selling NFL Media to Disney for equity in ESPN, while pushing more live games to Netflix and YouTube. That means fans need more apps, more logins, and more patience.

Basketball is heading the same way. The NBA just locked in massive national deals and is now working to bundle local team broadcasts into one national streaming product for the 2027 to 28 season. The price tag is expected to hit the billions. Even motorsport is shifting. After its rise on ESPN, Formula 1 signed a long-term deal with Apple worth around $140 million per year through 2031.

All this choice sounds great until the bill shows up. Fans are already frustrated by juggling platforms and rising costs. That frustration is pushing the industry toward what many call the great re-bundling. Services will likely start packaging sports together again, just under new owners. One league is moving faster than the rest. The UFC is dropping pay-per-view entirely.

Starting in 2026, every fight will stream on Paramount+ for $59.99 per year. That is a huge shift from $79.99 per event, and a direct attack on piracy and fan fatigue.

Technology is Running the Game Off the Field!

Bohl / Pexels / Tech in sports used to mean fancy scoreboards and replay screens. In 2026, it sits at the centre of decision-making.

AI is now part of daily training. Computer vision breaks down movement patterns. Digital athlete models predict injury risk before pain even shows up.

This tech boom is backed by serious money. The global sports technology market was valued at $22.86 billion in 2025 and is on track to reach $60.49 billion by 2030. Wearables drive roughly 33% of that revenue. Sensors track heart rate, muscle load, and recovery in real time. That data feeds AI systems that help teams train smarter and keep players healthier. The edge gained is small, but at elite levels, small wins games.

Plus, money is also changing who controls sports behind the scenes. After the University of Utah landed a $500 million investment from Otro Capital, similar deals across college sports are expected in 2026. Agencies and tech firms are merging to scale faster. At the top end, football clubs are turning into entertainment giants.

Real Madrid became the first club to generate over €1 billion in annual revenue, driven by stadium upgrades and nonstop commercial activity. Winning still matters, but owning the fan relationship matters more.

Fans, Experiences, and the 2026 World Cup Effect

Eslames / Pexels / Around 74% of fans now follow sports through social media, often consuming highlights instead of full games.

Short clips, reactions, and memes travel faster than broadcasts. This trend will peak during the FIFA World Cup 2026, hosted across the United States, Canada, and Mexico. The event will play out on feeds as much as on fields.

Experiences now beat possessions. About 53% of fans say they value experiences more than things. That mindset is boosting sports tourism. The tri-nation World Cup format encourages fans to turn matches into multi-city trips.

More in Football

-

`

How the Black Market Ticket Touts Are Sabotaging Football Safety

The black market for Premier League tickets is exploding, and it’s putting fans and football safety at risk. A recent BBC...

October 1, 2025 -

`

Why Drew Brees Thinks Bo Nix Could Be Sean Payton’s Dream QB

Bo Nix has a big fan in Drew Brees, and it is not just because they have thrown a few passes...

September 24, 2025 -

`

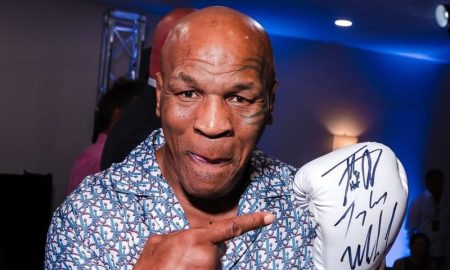

Boxing Legends Mike Tyson & Floyd Mayweather Set for Fight Amid Health Concerns

Mike Tyson is stepping back into the ring again, and this time it is with Floyd Mayweather. Two of boxing’s biggest...

September 17, 2025 -

`

Indiana Fever Player Caitlin Clark Turns Down $15 Million BIG3 Offer!

Caitlin Clark just said no to a $15 million offer from Ice Cube’s BIG3 league. The offer came not long after...

September 10, 2025 -

`

Judge Restricts Notorious ‘Alligator Alcatraz’ Operations in Landmark Ruling

The infamous immigration detention center known as “Alligator Alcatraz” just hit a legal wall. A federal judge dropped a major ruling...

September 3, 2025 -

`

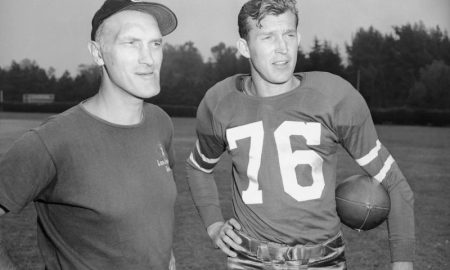

The Forgotten Military Leagues of All-Americans During World War II

Football didn’t stop for the war. In fact, it got even weirder. During World War II, football found a second home...

August 27, 2025 -

`

How Floyd Mayweather Schooled Canelo Álvarez and Made $42 Million

Floyd Mayweather walked into the ring in September 2013 with the calm confidence of a man who already knew the ending....

August 20, 2025 -

`

Hong Kong Hails Saudi Super Cup and Cultural Treasures in Historic Tourism Push

Hong Kong is turning up the heat this August, as Saudi Arabia brings a double dose of energy to the city:...

August 13, 2025 -

`

Floyd “Money” Mayweather’s Flight Company Sued for $136k in Unpaid Fuel

Floyd Mayweather is in the ring again, but this time it is a legal one. His private jet company, TBE Aviation...

August 6, 2025

You must be logged in to post a comment Login